The flood-affected areas of Mumbai and Kerala are now on the road to recovery after devastating downpour. If such a calamity were to hit your city and spoil your car, are you equipped to restore your ride back to its former glory? The what, why, and how of claiming insurance for flood-affected vehicles

Story: Joshua Varghese

Photography: Saurabh Botre

When was the last time you checked your insurance? Perhaps, when law enforcers demanded it? After a bit of rummaging around in the glovebox you might have triumphantly waved it under their nose and left the spot, once again returning the document to the dark recesses of your car. If you have not had the need to claim insurance yet, you may either be a great driver or one favoured by Lady Luck. However, should something unfortunate happen, are you prepared to claim insurance? Or, rather, do you know what exactly your policy entitles you to?

Simply explained, insurance is a guarantee that a company provides to issue compensation to third parties and/or the insured against specific losses and/or damage caused by the insured to themselves or to third parties. These companies provide these services and other add-on covers in return for a premium that is collected within a pre-specified time.

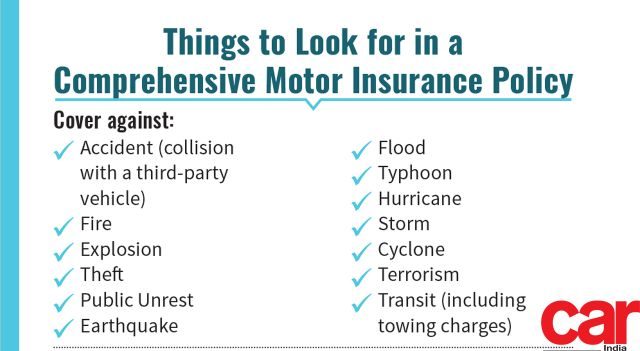

In our country, we have no shortage of insurance providers and they come in all shapes and sizes, offering schemes of various kinds. However, basically, motor vehicle insurance is of two types: liability-only policy and comprehensive policy. The former covers the owner’s liability towards a third party’s personal injury and property damage in the event of an accident. The latter covers all the risks under the liability-only policy plus loss or damage caused to the insured vehicle due to a list of causes that include natural and unnatural disasters as specified by the policy.

According to the Motor Vehicles Act, 1988, it is mandatory for every owner of a vehicle plying on public roads to take at least a liability-only policy. Furthermore, a certificate of insurance must be carried in the vehicle as proof of such insurance. However, a liability-only policy is only going to grant peace of mind to the third party in the event of a collision. The insured will have to take care of their personal injuries and damages to their vehicle by themselves.

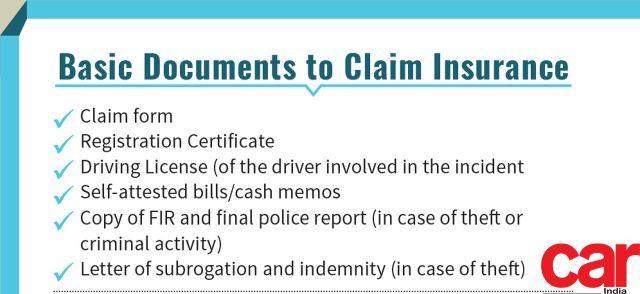

Which is why it is highly recommended to invest in a comprehensive insurance policy. In addition to taking care of the third party, it also covers almost all the costs incurred by the insured as well. Take a look at the table to check if your insurance policy has your back in the event of the listed unfortunate incidents. In the light of the recent floods in Mumbai and Kerala, owners may be worried about claiming insurance for their cars.

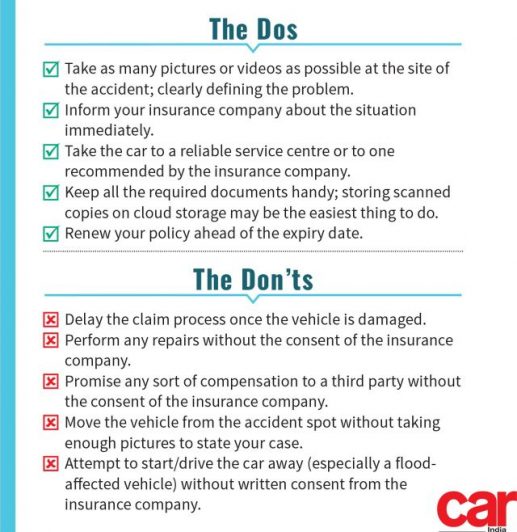

The good news is that you can claim insurance for repairs if your vehicle is covered by a comprehensive insurance policy. Your car can be considered “flood-damaged” if it has been standing in water up to the bumper for about an hour. Depending on the level of water, different parts or, maybe, the whole electrical system will be the first to go and can be quite expensive to replace without insurance. If your car is horribly water-damaged and beyond redemption, then you are also entitled to receive a certain amount of money based on the IDV (Insured’s Declared Value) of the vehicle. However, the insurance company will not entertain claims for damage incurred due to negligence such as driving through a water-logged area.

Most of us consider the claim process tedious and dismiss insurance agents in the same way we shoo away door-to-door salesmen. However, if you use all the digital resources at your disposal and finish your end of the job promptly, the process is a lot easier than it seems to be.

If the damage to your car can be repaired with a trivial amount (say, up to Rs 10,000), then we suggest you pay for it yourself. It is money saved in the long run. With a higher “No Claim Bonus” (NCB), you are entitled to reduced premia when you renew the policy. Furthermore, a spot-free record is usually rewarded with rebates, even at an international level.

Insurance companies often offer policies with an assortment of fine print that has some well-worded statements which may mislead your understanding of what exactly the policy covers. When you apply for an insurance policy, make sure you read the document carefully and comprehend it. In case of doubts, you can always seek legal counsel as well. Once you have carelessly “accepted terms and conditions”, you have lost the right to defend yourself if you feel that you are being offered an unfair compensation at the time of the claim. As well-wishers, we wish your insurance policy lives its life out as a document in your glovebox, but, should the need arise, we hope we were able to throw some light on how to restore your peace of mind.

Leave a Reply